Our Take: Trump Administration offers proposal to rein in prescription drug prices

May 14, 2018

On Friday, President Trump announced a much anticipated “blueprint” to control prescription drug pricing. In his remarks in the White House Rose Garden, Trump said, “The drug lobby is making an absolute fortune at the expense of American consumers.”

Our Take: Before we get into the takeaways, we must point out the obvious (and the most important non-event, from the perspective of drug manufacturers). By law, CMS is prevented from negotiating with drug companies for lower Medicare Part D prices or rebates, and Trump won’t be changing that.

Since the presidential campaign trail, Trump has vowed to negotiate Medicare drug prices. Drug manufacturers feared the worst, since CMS is by far their largest customer. Taking a haircut with CMS would have sizable effects on drug company profits.

But Congress has no appetite for amending the legislation, and Trump can’t act by executive order alone. Most analysts viewed the punt on Part D negotiations as a fait accompli.

Former Eli Lilly executive and Health and Human Services (HHS) secretary Alex Azar recently announced that HHS would “give Medicare Part D plans better tools to negotiate discounts on behalf of our seniors—tools that private-sector health plans often already use.” What those tools are, we don’t know.

Instead, President Trump called out “the middlemen,” presumably referring to pharmacy benefit managers (PBMs). “We’re very much eliminating the middlemen,” he said. “Whoever those middlemen were—and a lot of people never even figured it out—they’re rich. They won’t be so rich anymore.”

Just how he proposes to do that, however, remains unclear.

It is telling that pharmaceutical stock prices and PBM shares climbed after Trump’s speech.

But drug companies weren’t left entirely unscathed, at least not through his rhetoric. Trump noted that no industry spends more on lobbying than Big Pharma, and he’s right.

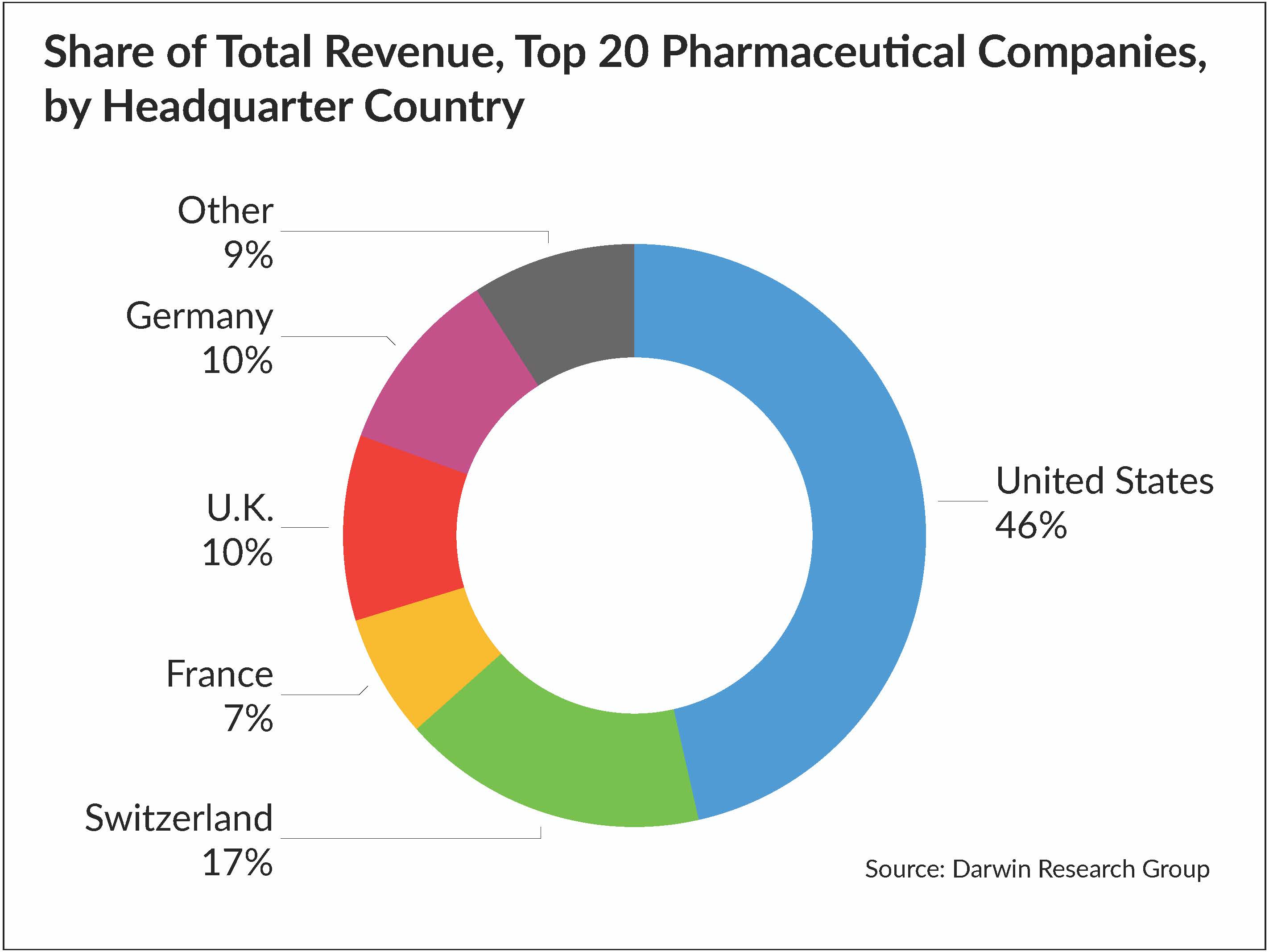

That said, he blamed high drug costs on unfair trade practices. “When foreign governments extort unreasonably low prices from U.S. drugmakers, Americans have to pay more to subsidize the enormous cost of research and development,” he said. Americans do pay higher prices for drugs, but the reasons are complicated and have nothing to do with fair trade. (It is also worth noting that only nine of the top 20 pharmaceutical companies are headquartered in the U.S.)

All in all, the speech was more motivational than substantive. But, Azar and FDA Commissioner Scott Gottlieb have a handle on the issue, and we expect changes coming that will have an impact on the margins—just not, as Trump put it, “the most sweeping action in history to lower the price of prescription drugs for the American people.”

In broad terms, the current administration is focused on four areas related to prescription drugs:

- Increased competition in drug markets

- Providing CMS better tools to negotiate prices

- Developing incentives for manufacturers to lower list prices

- Developing options for patients to lower their out-of-pocket drug costs

Azar said more details about the blueprint are forthcoming. We’ll keep you posted on the specifics as they are made available.

What else you need to know

Takeda and Shire Pharmaceuticals have agreed to merge, after weeks of negotiating and five failed Takeda proposals. According to the terms agreed upon by the boards of both companies, Takeda will pay $62 billion for Shire, consisting of approximately 46 percent cash and 54 percent stock. After the deal closes—which is expected in early 2019—Shire shareholders will own about 50 percent of the new entity, which will be headquartered in Japan. More here.

Danville, Penn.-based Geisinger announced that it is expanding its genomics program beyond the realm of research and into “routine” care for patients. In a press release, Geisinger said that within six months, its clinical DNA sequencing efforts will launch with a 1,000-patient pilot program, to be followed by a rollout throughout the entire system. “Geisinger patients will be able to work with their family physician to modify their lifestyle and minimize risks that may be revealed,” said Geisinger’s CEO, Dr. David Feinberg. “This forecasting will allow us to provide truly anticipatory health care instead of the responsive sick care that has long been the industry default across the nation.” More here.

UnitedHealthcare (UHC)’s bundled payment program for knee, hip and spine procedures has generated $18 million in savings for participating employers as a result of reduced readmissions and complications following surgery. In a press release, UHC said its Spine and Joint Solution program helped reduce hospital readmissions by 22 percent and led to 17 percent fewer complications for joint replacement surgeries as compared with nonparticipating facilities. For spine surgeries, hospital readmissions were reduced by 10 percent, and there were 3.4 percent fewer complications as compared with nonparticipating facilities. UHC said the program includes 46 participating health care facilities, with more than 115 employers enrolled representing 3 million employees. More here.

Amazon is building a health care team within its Alexa voice-assistant division, according to internal documents obtained by CNBC. Citing people familiar with the matter, CNBC reported that a 12-person team is working to make the Alexa voice assistant more useful in health care related issues, including working through HIPPA regulations and data privacy requirements. The group is focused on diabetes management and care for mothers, infants and the aging, according to the report. More here.

Valeant Pharmaceuticals will soon undergo a name change and a rebranding initiative, The Wall Street Journal reported. In July, Valeant will become Bausch Health, reflecting the name of one of its best performing businesses, Bausch + Lomb. Valeant has come under scrutiny by lawmakers for its pricing and accounting practices. Under new CEO Joseph Papa, the company is attempting to reinvent itself, and the name change is an effort to shed its past. “We think this name captures who we really are becoming,” Papa told the Journal. “We are much more than a pharmaceutical company.” More here.

What we’re reading

Providers partner with payers for bundled payments. Becker’s Hospital Review 5.10.18

Setting Achievable Benchmarks for Value-Based Payments: No Perfect Solution. JAMA 5.8.18 (Subscription required)

Precision Medicines Have Faster Approvals Based On Fewer And Smaller Trials Than Other Medicines. Health Affairs 5.7.18

By the numbers

Pharmaceuticals are a global business. Only nine of the top 20 and 16 of the top 50 pharma/biotech companies are headquartered in the U.S. We looked at total revenue (2017) for the top 20 pharmaceutical companies, then grouped them by where the firms are headquartered. No doubt about it: American companies dominate, but not to the degree one might expect.