Our Take: Texas health systems sign letter of intent to merge

Oct 08, 2018

Baylor Scott & White Health (BSW) and Memorial Hermann Health System have signed a letter of intent to merge. In a statement, the organizations said their next step is to complete a due diligence and regulatory review prior to signing a definitive agreement, which is expected to occur in 2019.

The combined system will include 70 hospitals across 30 Texas counties, with 73,000 employees and nearly $11 billion in annual net patient revenue—making it one of the 10 largest integrated delivery systems in the U.S.

“This is about two mission-driven organizations—both committed to making safe, high-quality health care more convenient and affordable—building something transformative together,” said Jim Hinton, CEO of BSW.

Hinton will be the CEO of the proposed combined system; his executive team will include Chuck Stokes, president and CEO of Memorial Hermann, and Pete McCanna, president of BSW. The health systems said a unified board would be created with equal representation from both organizations.

The new organization will have executive and support staff based in Austin, Dallas, Houston and Temple.

“Through this combined system, we have a unique opportunity to reinvent health care and make a profound difference in the lives of millions of Texans,” said Stokes.

Our Take: This deal has been in the works for some time, evidenced by a polished website that was ready to go at launch—replete with feel-good videos—proclaiming that the two organizations are “transforming health together” for the good of all Texans.

“Texans need organizations with histories of leadership like ours to step up,” the website touts, noting candidly that “Texas ranks 44th in overall health, and Texas has the highest uninsured rate in the nation.”

Memorial Hermann facilities reside primarily in the greater Houston area, while BSW spans the area from Austin to Dallas-Ft. Worth. There’s virtually no overlap in the markets they serve, and in each highly competitive city they are the market leader.

BSW is about twice the size of Memorial Hermann, and with Hinton as the proposed new CEO, the deal feels more like an acquisition than a merger of equals. BSW also has more pieces of the integrated delivery spectrum, having several large physician groups, more lives under management in its health plan and a larger post-acute presence.

There are other differences. For instance, Medicaid represents about 15 percent of Memorial Hermann’s revenue, but only 6 percent of BSW’s revenue.

Memorial Hermann also has a stronger retail presence than BSW does.

Yet, both systems are on a strikingly similar path from volume to value. Memorial Hermann manages several hundred thousand lives in multiple ACO agreements, and its MSSP ACO has consistently been one of the top-performing ACOs in shared savings. In its first five years, Memorial Hermann’s MSSP ACO had gross shared savings of more than $260 million.

Baylor Scott & White Quality Alliance (BSWQA) took a little longer to enter the MSSP and hasn’t performed as well financially, but it manages a similar number of lives through multiple ACOs with an outstanding track record for quality.

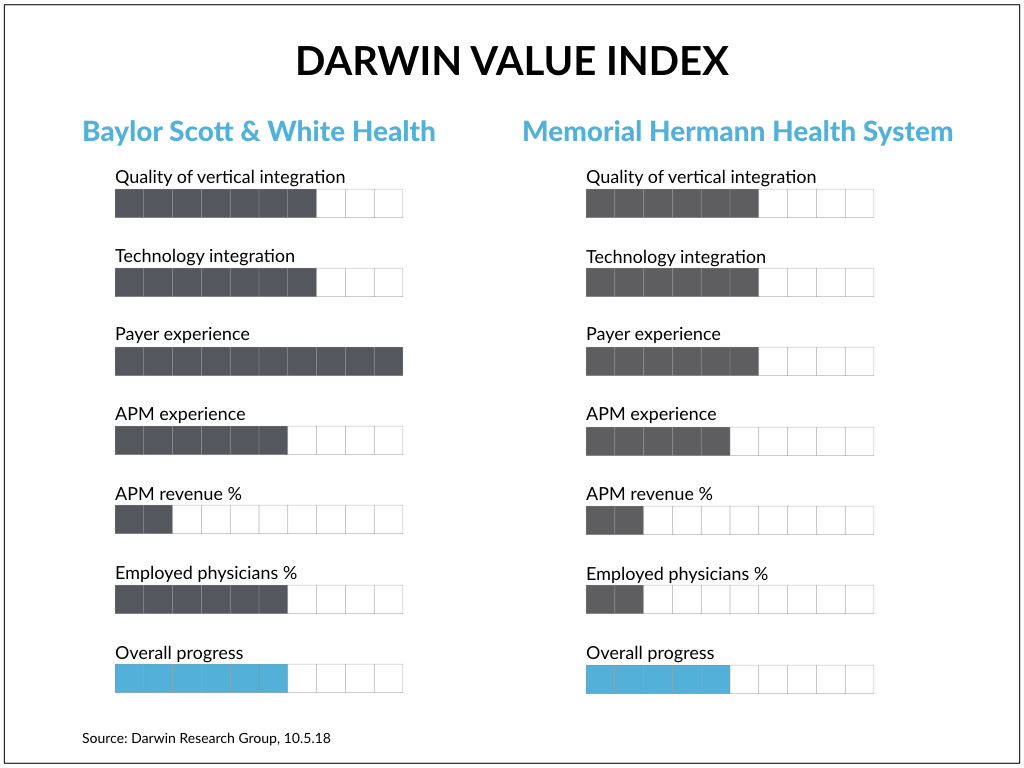

In the Darwin Value Index—our model for measuring a system’s movement from fee-for-service to value-based care—Memorial Hermann and BSW score similarly, with a slight edge going to BSW. (See below.)

Ultimately, as the leaders of both organizations point out, BSW and Memorial Hermann have a shared faith-based history, comparable cultures and a similar purpose—all of which will increase the combined system’s chances for long-term success.

Looks like a good fit to us.

What else you need to know

In other merger and partnership news:

- UnitedHealth Group acquired Genoa Pharmacy Group from Advent International, a private equity firm, in a deal valued at $2.5 billion. Genoa runs 425 pharmacies in 46 states and will be integrated into UnitedHealth’s OptumRx unit to improve care for patients with behavioral health and substance abuse problems, Bloomberg reported.

- Partners HealthCare was granted expedited review by the Rhode Island Department of Health regarding the proposed merger with Care New England. Under expedited review, a public hearing is not required.

- Spectrum Health finalized its merger agreement with Lakeland Health last Monday. Based in St. Joseph, Mich., Lakeland operates three hospitals and has 450 physicians, nurses and other providers.

- Henry Ford Health System and Wayne State University signed a letter of intent to formalize their partnership to collaborate in patient care and research, and to expand “an innovative curriculum for the education and training of the next generation of medical and health professionals.”

Trinity Health announced the formation of a new five-hospital regional system based in Philadelphia, known as Trinity Health Mid-Atlantic. The new system includes Mercy Philadelphia Hospital, Nazareth Hospital (Philadelphia), St. Mary Medical Center (Langhorne, Pa.), Saint Francis Healthcare (Wilmington, Del.) and Mercy Fitzgerald Hospital (Darby, Pa.). Mercy said the new system also includes its home health, LIFE and other programs and subsidiaries. According to Mercy, James Woodward, president and CEO of St. Mary Medical Center, has been appointed Trinity Health Mid-Atlantic president and CEO and will lead the formation of a regional executive team. More here.

CMS announced a new and improved user experience for Medicare beneficiaries through eMedicare, a multiyear initiative to streamline and modernize the way beneficiaries get information. “The road map for this program will enhance opportunities to go digital, offer additional self-serve options and create a seamless multichannel customer service experience,” CMS said. Some of the announced enhancements set to go live include an improved coverage wizard, a mobile-optimized out-of-pocket cost calculator, a simplified login for the Medicare Plan Finder and a web chat option within the Plan Finder. More here.

Hackensack Meridian Health announced a new three-region structure “to better align its services and improve the overall experience for patients” across its 16 hospitals and other sites in New Jersey. Dr. Ihor Sawczuk will serve as president of the north region, Ray Fredericks as president of the central region and Dr. Kenneth Sable as president of the south region. More here.

What we’re reading

Patient-Centered, Value-Based Health Care Is Incompatible With The Current Climate Of Excessive Regulation. Health Affairs 10.3.18

Crossing the Global Health Care Quality Chasm: A Key Component of Universal Health Coverage. JAMA Viewpoint 10.2.18 (subscription required)

A prescription for blockchain and healthcare: Reinvent or be reinvented. pwc Health Research Institute 9.27.18

Why Doctors Shouldn’t Dismiss the Apple Watch’s New ECG App. Harvard Business Review 10.5.18

By the numbers

The Darwin Value Index measures a health system’s progression from fee-for service to value-based care on a 10-point scale for six measures, then averages those measures to obtain an overall score. While the Index is admittedly subjective, we score each measure based on our interviews with system executives and our proprietary databases, and in relation to other integrated health systems.

In addition to the percentage of revenue derived from alternative payment models (APMs) and the percentage of physicians employed by the system, we also score the quality of vertical integration, level of technology integration, payer experience and experience with APMs.