Our Take: Top drugmakers reveal strong performances in Q1 earnings reports

Several top pharmaceutical companies have released their first-quarter earnings reports in the last couple of weeks, with most meeting or exceeding analysts’ estimates.

AstraZeneca, for example, saw a 17% increase in total revenue compared with last year’s first quarter ($12.7 billion vs. $10.9 billion). Operating profit was up 22%, at $3.1 billion. The company’s oncology portfolio accounted for $5.1 billion of overall sales, an increase of 23% from the same quarter a year ago. Sales of AstraZeneca’s metabolic and cardiovascular drugs accounted for another $3.1 billion of the sales total, an increase of 22% from 2023’s initial quarter.

The U.K.-based drugmaker has focused its growth efforts on acquisitions, spending over $5 billion since late last year to acquire four drug companies: Icosavax, Gracell Biotechnologies, Amolyt Pharma, and Fusion Pharmaceuticals.

AbbVie also topped consensus forecasts. Although the company’s net revenue for the quarter was essentially flat compared with the same quarter of 2023, at $12.3 billion, and the company’s earnings per share (EPS) decreased from $2.46 in the first quarter of 2023 to $2.31 in the most recent quarter, analysts’ consensus estimates were for a profit of $2.23 per share on revenue of $11.9 billion.

So far, AbbVie has experienced a slower-than-anticipated decline in sales of top-selling Humira (adalimumab) following the loss of patent exclusivity last year. While Humira sales decreased 35.9% in the most recent quarter relative to the first quarter of 2023, sales of Skyrizi (risankizumab) and Rinvoq (upadacitinib) were up 47.6% and 59.3%, respectively. The two drugs treat several of the same conditions as Humira.

Johnson & Johnson reported quarterly net earnings of $5.3 billion (vs. a loss of $491 million in the previous year’s first quarter, which included a special one-time charge in connection with the company’s talc liabilities and the spinoff of consumer health company Kenvue). The company’s adjusted EPS increased 12.4% quarter over quarter, from $2.41 to $2.71.

Stelara (ustekinumab), J&J’s immunosuppressive drug for Crohn’s disease, ulcerative colitis, plaque psoriasis, and psoriatic arthritis, is set to start losing patent exclusivity in September, opening the door to competition from biosimilars. J&J completed its $2 billion acquisition of Ambrx Biopharma, which specializes in next-generation antibody drug conjugates, last month.

Merck beat Wall Street’s expectations for the first quarter with strong sales of cancer drug Keytruda (pembrolizumab), which increased 20% from the same quarter a year ago ($6.9 billion vs. $5.8 billion), and the company’s Gardasil vaccine products, which increased 14% from 2023’s first quarter ($2.2 billion vs. $2.0 billion).

With Keytruda facing the start of patent expiry in 2028, Merck is looking at drugs like its recently approved treatment for pulmonary arterial hypertension, Winrevair (sotatercept), to offset the eventual dip in Keytruda sales.

The company reported a 9% increase in revenue ($15.8 billion vs. $14.5 billion in Q1 of 2023), net income of $4.8 billion (vs. $2.8 billion in Q1 of 2023) and adjusted EPS of $2.07 (vs. $1.40 in Q1 of 2023 and vs. the $1.88 EPS analysts expected).

Novartis beat expectations as well, reporting adjusted operating income of $4.5 billion (a 16% increase from the previous year’s first quarter), net sales of $11.8 billion (a 10% quarter-over-quarter increase), and net income of $2.7 billion (a 25% increase from Q1 of 2023).

After completing the spinoff of its Sandoz generics unit last fall, the Swiss pharma giant has turned its sights toward shoring up its pipeline. Earlier this month, Novartis initiated a tender offer to acquire MorphoSys, an oncology-focused biopharma based in Germany, for $2.9 billion and announced a partnership with Arvinas, a New Haven, Conn.-based biotech that develops targeted protein degradation therapeutics.

The first quarter was less positive for a couple of other Big Pharma constituents.

Although Bristol Myers Squibb beat analysts’ estimates by reporting revenue of $11.9 billion in the first quarter, an increase of 5% from the same period a year ago, the company also reported a quarterly loss of $5.89 per share (compared with an EPS of $1.07 in the first quarter of 2023), largely resulting from the recent acquisition of Karuna Therapeutics.

Since October, BMS has entered into deals to acquire Karuna, RayzeBio, and Mirati Therapeutics, at a collective cost of nearly $24 billion.

In an effort to lower costs by approximately $1.5 billion before the end of 2025, BMS is implementing a “strategic productivity initiative” that will entail a workforce reduction of 6%, or about 2,200 employees. The company has also discontinued a dozen programs from its investigational drug pipeline, according to Biopharma Dive.

Sanofi’s business operating income decreased 14.7% (to 2.8 billion euros) in the first quarter relative to the same period of 2023, and the company’s business net income and business EPS decreased 17.8% and 17.6%, respectively. The decreases were, in part, the result of currency effects and generic competition for multiple sclerosis drug Aubagio (teriflunomide), which lost patent exclusivity in the U.S. a year ago.

Sales of Dupixent (dupilumab), which is indicated for eczema and as an adjunct therapy for asthma, increased 24.9% quarter over quarter, bringing in 2.8 billion euros.

What else you need to know

Kaiser Foundation Health Plan reported a data breach that may have exposed the names and internet protocol addresses of an estimated 13.4 million people. The exposed data apparently did not include login credentials, Social Security numbers, or credit card information. The insurance company, part of Kaiser Permanente, reported the breach to the Department of Health and Human Services on April 12 and the report was made public on Thursday, according to Modern Healthcare. Kaiser Permanente said in a statement shared with various news outlets that an internal investigation found “certain online technologies, previously installed on [Kaiser’s] websites and mobile applications, may have transmitted personal information to third-party vendors” including Google, Microsoft Bing, and X (formerly Twitter). Kaiser Permanente said it has removed the online technologies and is notifying those who may have been affected by the breach.

In separate news, Reuters reported last Monday that UnitedHealth Group finally confirmed payment of a ransom to hackers who stole protected health information and personally identifiable information in the Change Healthcare cyberattack in February. The company said in a press release that the stolen data potentially covers “a substantial proportion of people in America” and that it could take “several months of continued analysis before enough information will be available to identify and notify impacted customers and individuals.”

UnitedHealth Group’s Optum is closing its telehealth business, Endpoints News reported and the company later confirmed. Optum Virtual Care launched in 2021, providing users 24/7 access to physicians and nurse practitioners in every state. In a written statement, a UHG spokesperson said, “Virtual care has been, and will continue to be, a core part of our comprehensive, integrated care delivery model …. As an enterprise, we are committed to providing patients with a robust network of providers for virtual urgent, primary, and specialty care options.”

In related news, UHG’s Landmark Health, which provides at-home medical care in 37 states, is downsizing, laying off as many as 500 employees, according to Fierce Healthcare. The news outlet also reported that Optum appears to have laid off “a significant percentage of its workforce.” The information was obtained from message boards, social media posts, and anonymous sources, Fierce Healthcare noted, adding that the companies have not commented on the layoffs.

The use of artificial intelligence in drug discovery took a major leap forward with the launch of a new biotech called Xaira Therapeutics. Based in San Francisco, the startup is being funded by co-founders ARCH Venture Partners and Foresite Labs, along with about a dozen other venture capital firms and organizations — to the tune of more than $1 billion. Dr. David Baker, director of the Institute for Protein Design, is also a Xaira co-founder. The funding will be used to advance models for protein and antibody design developed by researchers in Dr. Baker’s lab at the University of Washington School of Medicine and to develop new models. Xaira’s founding CEO is Marc Tessier-Lavigne, who previously served as chief scientific officer at Genentech and as president of Rockefeller and Stanford universities. Other members of the executive team worked at Genentech as well. The launch announcement noted that Xaira’s internal platforms incorporate technologies and personnel from Illumina’s functional genomics R&D effort, and that Xaira has also integrated a proteomics group from Interline Therapeutics.

Advocate Aurora Health is planning to sell MobileHelp, a medical alert and remote patient monitoring company Advocate Aurora Enterprises (Advocate Aurora Health’s investment arm) bought in 2022, Becker’s Healthcare reported, citing an audited financial report. A month ago, Advocate Aurora Health sold Senior Helpers, a provider of in-home care for older adults, to Waud Capital Partners, a private equity firm; Advocate Aurora Enterprises bought that company in 2021. Advocate Aurora Enterprises paid approximately $478 million for the two companies. Advocate Aurora Health is now part of Charlotte, N.C.-based Advocate Health after combining with Atrium Health.

Walgreens is integrating and expanding its specialty pharmacy services to include gene and cell therapy services. The company introduced Walgreens Specialty Pharmacy on Thursday, referring to the rebranded business as “a holistic offering” that will include a new Gene and Cell Services Pharmacy and Innovation Center in Pittsburgh, along with four central specialty pharmacies, nearly 300 community-based specialty pharmacies, more than 1,500 specialty-trained pharmacists, and “a growing roster” of 240 limited distribution drugs. AllianceRx Walgreens Pharmacy, which provides specialty and home delivery pharmacy services, will become Walgreens Specialty Pharmacy on Aug. 1. Shields Health Solutions will continue to support health systems’ specialty pharmacies.

Health Care Rounds #166: ChatGPT, MD — A conversation about AI with Dr. Robert Pearl

Health Care Rounds #166: ChatGPT, MD — A conversation about AI with Dr. Robert Pearl

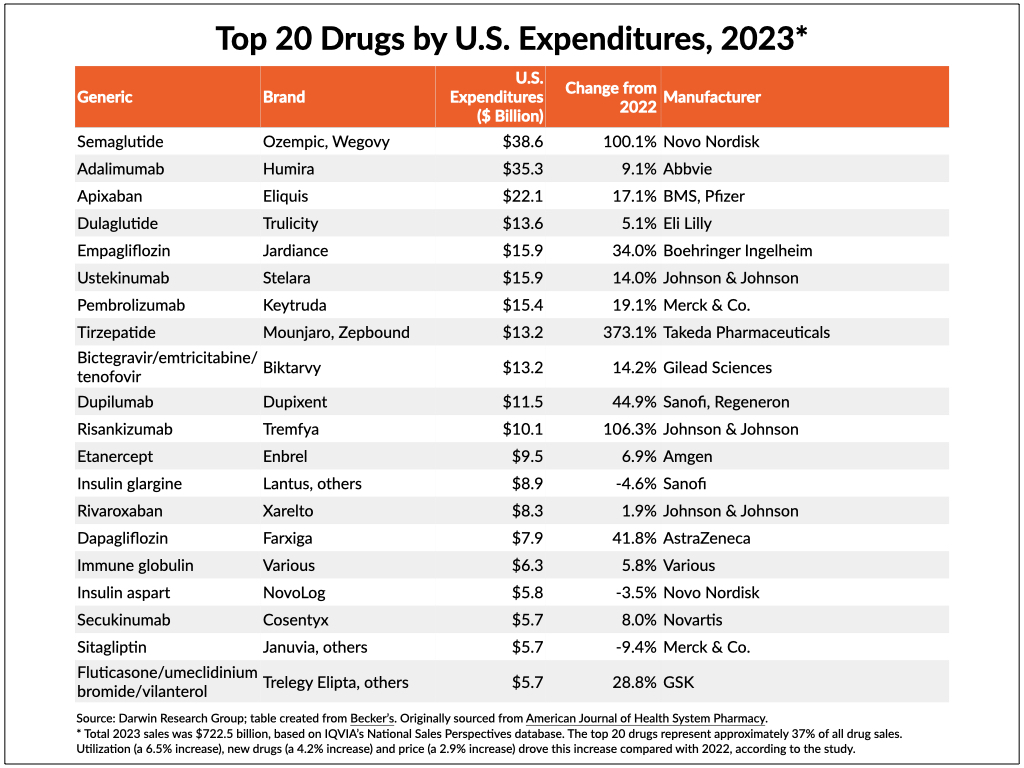

Ever wonder why prescription drugs cost so much? In this episode of Health Care Rounds, Alison Lum (VP of Pharmacy Services, Blue Shield of California) joins John to peel back the layers of the complex world of pharmaceutical pricing and sheds light on the misleading list prices, opaque rebates, and tangled web of stakeholders that contribute to skyrocketing medication costs. Listen here or wherever you get your podcasts. Now available on YouTube.

What we’re reading