Our Take: Cigna to Acquire Express Scripts

Mar 12, 2018

Cigna announced that it has agreed to acquire pharmacy benefit manager (PBM) Express Scripts for a total of approximately $67 billion, including assumption of $15 billion in Express Scripts debt. Upon closing of the agreement, the combined company will be led by David Cordani as president and CEO. Tim Wentworth will assume the role of Express Scripts president. Together, the two companies will have nearly $142 billion in annual revenue.

Cigna and Express Scripts said the combined entity will offer a “full suite of medical, behavioral, specialty pharmacy and other health engagement services accessible across a wide array of retail and online distribution channels.”

For each of their shares, Express Scripts investors get $48.75 in cash plus 0.2434 shares in the combined company, a 31 percent premium to the company’s closing price last Wednesday. After the transaction closes, Cigna shareholders will own 64 percent of the new company and Express Scripts shareholders will own 36 percent. The agreement is subject to shareholder and regulatory approvals. The companies said the deal is expected to close by yearend.

Our Take: Investors punished Cigna for the move, sending shares down 12 percent by Friday’s close to $173.40 per share. We can’t understand why.

This is a pure profit play for Cigna, regardless of any interim debt the company will sustain. By having its PBM services in-house, Cigna simultaneously lowers its cost structure and absorbs the profits of the largest stand-alone PBM.

Consider the magnitude: In 2017, Express Scripts had $4.1 billion in net income on $141.1 billion in revenue, while Cigna posted $2.2 billion in profit on $41.6 billion in revenue. That’s nearly a 200 percent bump in earnings.

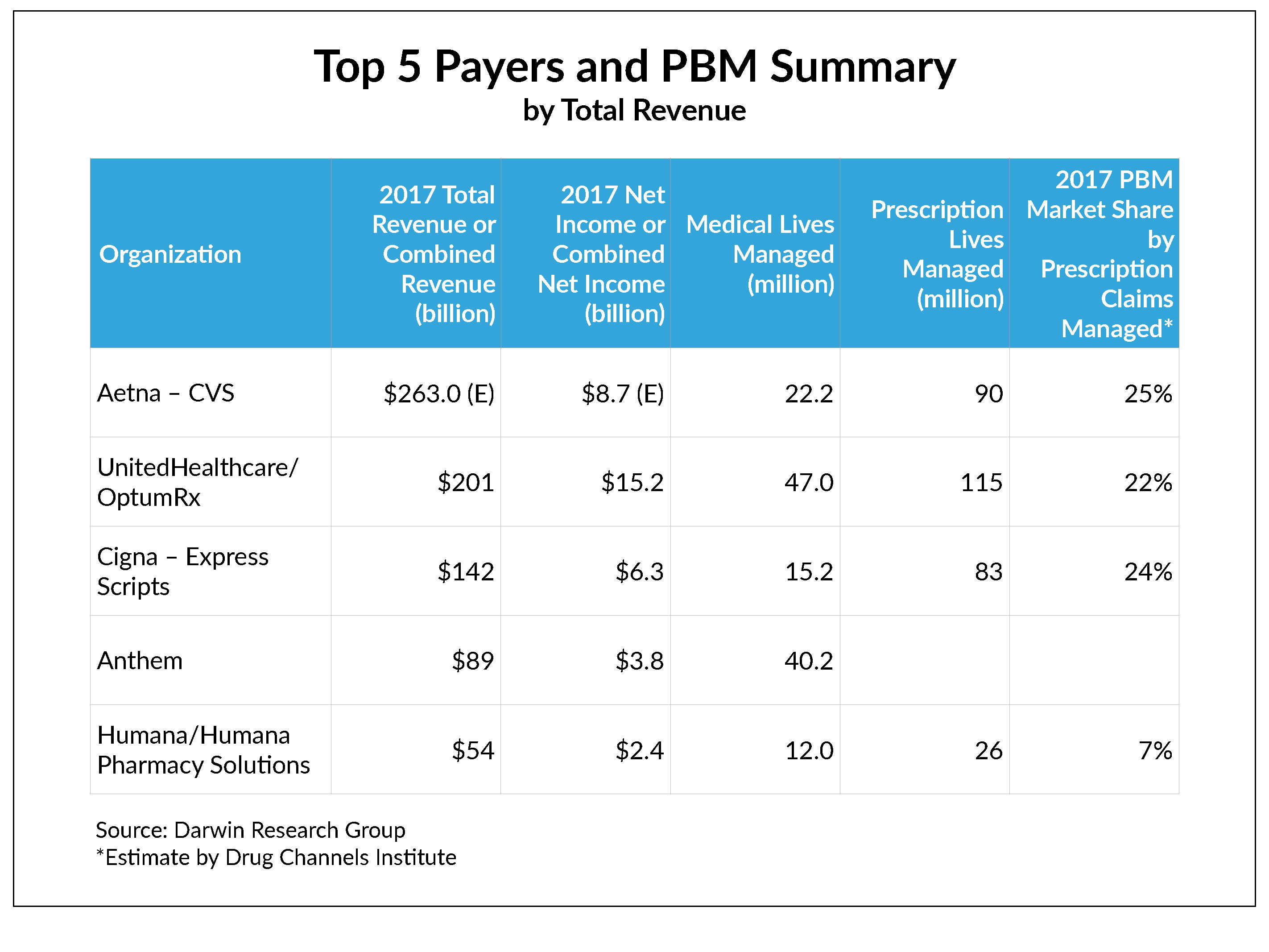

Now, consider the playing field. CVS is the leading PBM, with 25 percent of total prescription claims managed, according to Drug Channels Institute. (Express Scripts is a close second, with a 24 percent share.) In December 2017, CVS announced that it was buying Aetna for $69 billion—remarkably close to what Cigna is paying for Express Scripts. If these transactions are approved, that means that three of the top five payers will be managing more than 70 percent of prescription claims.

This is a seismic shift.

With the added lives under management and a vertically integrated PBM, Cigna has potentially increased its negotiating position for drug pricing and rebates from drug manufacturers. And, having a vertically integrated PBM should allow Cigna the means to facilitate a value-based or outcomes-based pricing strategy—which to this point has been a novel and relatively rare concept for PBMs—should Cigna wish to pursue it.

Despite the rhetoric you will hear from management about the virtues of these mergers for consumers and companies, make no mistake: Consumers won’t see lower copays, and employers will continue to watch their drug budgets balloon. Considering UnitedHealthcare’s announcement last week (see below), it’s possible that consumers might see lower drug prices if Cigna also shares some rebate dollars. But with all that profit on the line, it’s hard to say how much.

What else you need to know

Google is taking aim at organizing health records through a new application programming interface (API) for Google Cloud, CNBC reported. The API can handle disparate types of health data, such as images, laboratory test results and medical histories. Several hospitals have signed on to a pilot program, including Stanford Medicine. “I see the impact that availability of data can have in medicine, and the need for it is urgent,” said Greg Moore, Google Cloud’s vice president of health care. “Getting data to patients, caregivers and providers is key.” More here.

HHS Secretary Alex Azar issued a bold policy speech to the Federation of American Hospitals last week, outlining four areas of emphasis, all related to value-based transformation. The four areas are: giving consumers greater control over health information through interoperable and accessible health information technology; encouraging transparency from providers and payers; using experimental models in Medicare and Medicaid to drive value and quality throughout the entire system; and removing government burdens that impede value-based transformation. “Today’s health care system is simply not delivering outcomes commensurate with its cost,” Azar said. Read his remarks here.

Speaking at HIMSS18 on Monday, CMS Administrator Seema Verma said the agency plans a “complete overhaul” of the Meaningful Use program later this year. “We’re moving away from giving credit to physicians for just having an EHR to actually making sure that it is focused on interoperability and giving patients their data,” Verma told reporters after her speech. She also announced two new initiatives: MyHealthEData, a program to increase data interoperability, and Blue Button 2.0, an API to allow for better mining of Medicare claims data. Blue Button 2.0 builds on an effort that began in the Obama administration. Read her remarks here.

The state of Idaho’s move to allow insurers to sell health plans that charge people with pre-existing conditions more has been blocked by the Trump administration. Regarding Idaho’s “Provisions for Health Carriers Submitting State-Based Health Benefit Plans,” CMS said it “is committed to working with states to give them as much flexibility as permissible under the law to provide their citizens the best possible access to health care,” but the agency noted that the Idaho plan was in violation of the Affordable Care Act. Read the enforcement letter here.

UnitedHealthcare (UHC) announced plans to share the pharmacy discounts it gets from drug manufacturers to more than 7 million people enrolled in its fully insured commercial group benefit plans, beginning Jan. 1, 2019. The new program is designed to lessen out-of-pocket costs by applying these drug rebates up front at the time of sale. UHC’s CEO, Dan Schumacher, told The New York Times that “the benefit could range from a few dollars to a few hundred dollars,” mostly affecting consumers with high-deductible plans who buy drugs carrying large rebates. More here.

What we’re reading

Does CVS-Aetna Spell the End of Business As Usual? NEJM 2.15.18