Our Take: Court rules insurers aren’t owed Obamacare payments

Jun 18, 2018

A federal appeals court Thursday ruled that the Health and Human Services Department is not obligated to pay insurers the more than $12 billion in risk corridor payments that have accrued to date. The U.S. Court of Appeals for the Federal Circuit reversed a previous decision in a suit brought by Moda Health, in which the company argued that it was owed risk corridor payments as stipulated by the Affordable Care Act (ACA).

In its ruling, the court said the program “lacks the trappings of a contractual agreement.”

Our Take: We’ve written about this issue previously, but for those who missed it, here’s a refresher.

The three-year risk corridor program, which ended in 2016, was designed to encourage insurers to participate in the individual insurance exchanges by protecting them against extreme losses. Payers whose costs were below a set amount paid into the program, and those funds were then redistributed to insurers whose costs exceeded a set amount.

Led by Sen. Marco Rubio (R-Fla.), Congress nixed the program in December 2014 with an appropriations bill that blocked any extra payments for the program beyond the “user fees” collected from profitable insurers. Three years of unpaid funds owed to insurers amounted to about $12 billion.

Ironically, the risk corridor program was modeled after a similar scheme in the Medicare Part D drug benefit that was enacted when Republicans controlled both chambers of Congress and the White House.

We cannot overestimate the damage that the 2014 appropriations bill has done to insurance markets—and to consumers—across the country. Insurers were promised this money through the ACA as a means to encourage participation on the exchanges. When Congress reneged on its promise, payers balked and headed for the exits. Lacking competition, premium price increases ensued.

In our opinion, if there were a single event we could point to, should the ACA finally crumble, it would be the 2014 appropriations bill.

One might rightly point out that premium increases were inevitable because premiums were underpriced to begin with, which is why some payers—not all—lost money in certain markets. But it is hard to argue that premium price increases would be as steep if there were healthy competition among health insurance plans.

The court’s latest ruling is a blow to insurers who now, for the second time, have been denied funds they expected.

Remember, the risk corridor program, along with reinsurance and risk adjustment (referred to as the “3 Rs by policy wonks), existed to encourage the entry of payers in a new insurance market and to stabilize premiums as the program got underway.

Thursday’s ruling caps a string of bad news for insurers, who face mounting uncertainty in ACA marketplaces—and for consumers, who will continue to see rising premiums on the exchanges. The Trump administration has pushed for plans that don’t meet ACA requirements, such as short-term plans and association health plans. For a time last year, the administration stopped cost-sharing reduction payments to payers, angering insurers.

Just over a week ago, Attorney General Jeff Sessions announced that the Justice Department would no longer defend the Affordable Care Act, saying two important parts of the law should be invalidated and the individual mandate is unconstitutional.

The bottom line: Lawmakers who drafted the 2,409-page Patient Protection and Affordable Care Act cannot be excused for excluding language that would have guaranteed funding for the risk corridor program, given that it was such an important part of the legislation. If they had, we wouldn’t be fighting it out in the courts.

What else you need to know

Harvard Pilgrim CEO Eric Schultz abruptly resigned Tuesday, citing unspecified “behavior” as the reason for his departure. “It’s with mixed emotions that I inform you that today will be my last day as CEO of Harvard Pilgrim Health Care and Chair of the Harvard Pilgrim Health Care Foundation,” Schultz wrote in a letter to Harvard Pilgrim’s board of directors and employees. “Regrettably, I recently exhibited behavior that was inconsistent with my personal core values and the company’s core values and code of conduct.” As of this writing, no other details were provided by Harvard Pilgrim. Schultz’s resignation comes on the heels of the resignation of AthenaHealth CEO Jonathan Bush, who stepped down after more than two decades of leading the health care IT firm. More here.

Walmart has selected University Hospitals (UH) Cleveland Medical Center for a bundled payment program for joint replacement procedures, becoming the retailer’s 11th Center of Excellence. In a press release, UH said eligible Walmart medical plan enrollees who receive joint-replacement surgery services at UH Cleveland Medical Center would receive enhanced benefits, such as 100 percent coverage of all procedure costs, along with travel, lodging and an expense allowance for the patient and a caregiver. UH said its Center of Excellence care process includes a review of the patient’s medical records, a team evaluation process of evidence-based treatment protocols, a care plan, patient and caregiver education, inpatient and outpatient care, management of the transition home and collaboration with the patient’s local physicians. More here.

CMS has been miscalculating the star ratings given to hospitals on the agency’s Hospital Compare website for roughly two years, according to an analysis by Rush University Medical Center, Modern Healthcare reported. Consumers frequently use the star ratings when deciding where to seek care, and the ratings are also commonly used in contract negotiations with payers. CMS said on Tuesday that it was postponing the planned release in July of an update to the ratings. More here.

Private equity firm KKR will acquire Envision Healthcare, a provider of physician staffing services, for $9.9 billion. Envision offers physician-led, ambulatory surgery and post-acute care services to more than 1,800 clinical departments in health care facilities in 45 states and Washington, D.C. The company owns and operates 261 surgery centers and one surgical hospital and provides home health care services though its Evolution Health unit. The deal has been approved by the Envision’s board of directors and is expected to close by the end of the year. More here.

Billionaire, biotechnology entrepreneur and surgeon Patrick Soon-Shiong plans to take his experimental cancer treatment company public by the end of the year, Reuters reported. The new firm, called Nant, currently has six compounds in clinical trials that target nine tumor types. Dr. Soon-Shiong has twice launched and sold biotech companies. In 1997 he founded APP Pharmaceuticals, a diabetes and cancer-focused drug manufacturer, which was sold to Fresenius SE for $4.6 billion in 2008. Dr. Soon-Shiong later founded Abraxis BioScience, which sold to Celgene in 2010 for $3 billion in cash and stock. More here.

Stryker Medical is in talks to acquire Boston Scientific, according to reporting by The Wall Street Journal. The combined company would have more than $21 billion in annual sales and a market value of $110 billion. Company representatives did not respond to requests for comment by The Journal. More here (subscription required).

What we’re reading (and listening to)

The Evolving Pharmaceutical Benefits Market. JAMA 6.12.18

Value-based Pricing for Drugs: Theme and Variations. JAMA 6.5.18

The Most Vilified Industry in America Is Also the Most Charitable. Freakonomics (audio link) 5.23.18

By the numbers

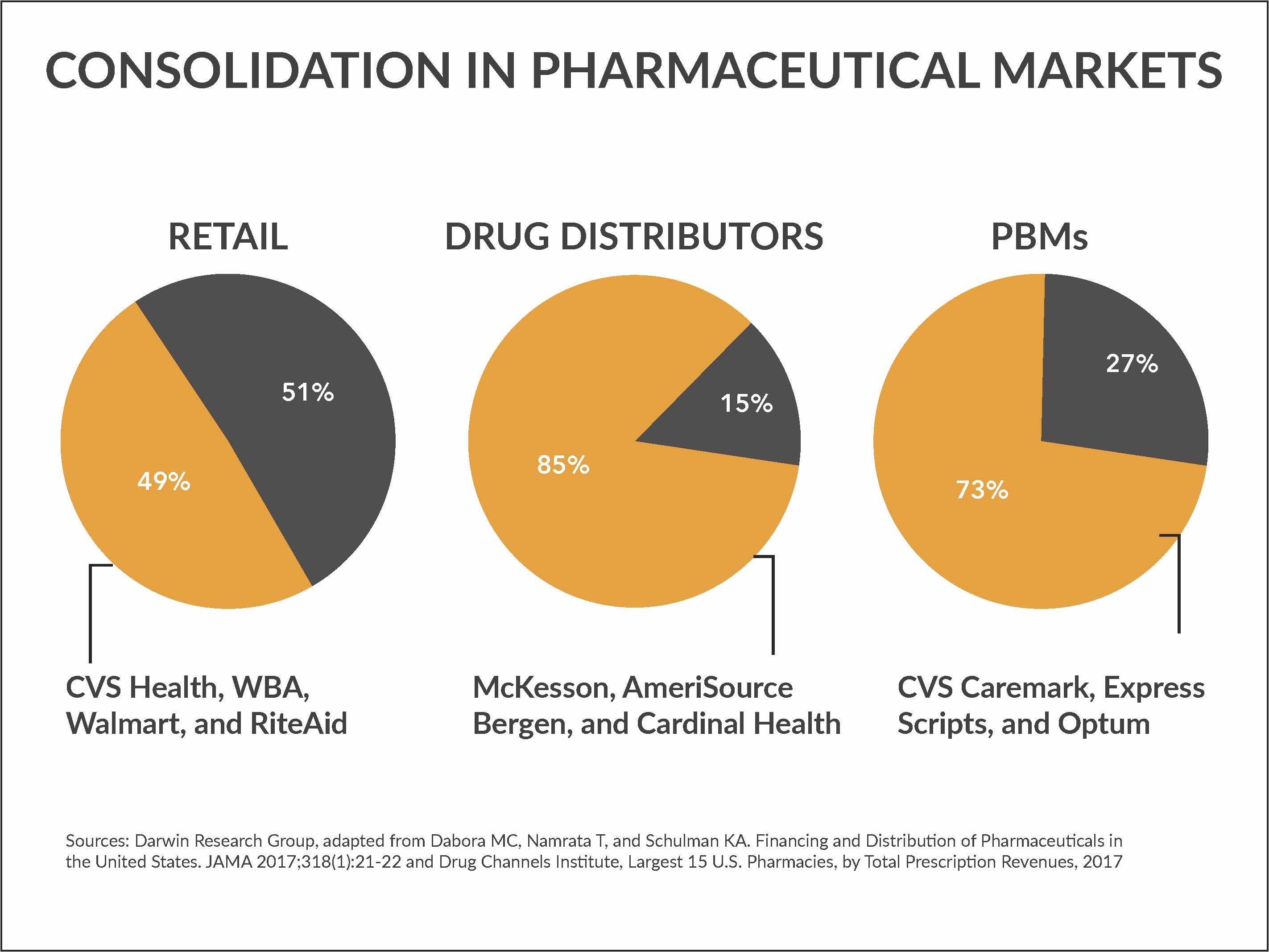

It’s staggering to see the level of power concentrated in so few hands. Whether it’s retail pharmacy, wholesale distribution or pharmacy benefit management, just a few key players control a large swath of the pharmaceuticals market. For instance, four retail pharmacies—CVS Health, Walgreens Boots Alliance (WBA), Walmart and Rite Aid accounted for about half of all total prescription revenues in 2017. (Rite Aid was sold earlier this year to WBA and Albertson’s.) And according to Drug Channels Institute, 15 retail and mail order pharmacies represent 74 percent of prescription drug dollars.